Post-Incorporation Notification to the Bank of Japan

Under Japan's Foreign Exchange and Foreign Trade Act (FEFTA), foreign companies looking to establish a subsidiary in Japan often need to submit a posterior report to the Bank of Japan, otherwise known as post-incorporation notification. Incorporation service providers or global expansion companies can help, if you need.

Hire More Full-Time Employees

Following successful incorporation of your business, the first employees hired through temporary method should be converted to direct hire full-time employees. In addition, incorporating allows you to attract top talents in the market to be hired under your business. Headhunters can help you for hiring as described in the previous page.

Employee Management

To manage payroll, tax, and social insurance & benefits statutory in Japan for full-time employees after incorporating your business, it is recommended to seek the assistance of service providers such as tax accountants or HR consultants. Global expansion companies also provide employee management services.

Opening a Bank Account in Japan

For salary payment to direct hire full-time employees, the newly incorporated company need a bank account in Japan to manage tax withholding, etc. At latest, a bank account needs to be ready to pay corporate tax in 2 to 3 months after the fiscal year end of the new company. Opening a bank account in Japan for a new company is difficult in general, because of their lower credibility with no credit record. In addition, there are strict KYC processes due to anti-money laundering requirements. It may take 2 to 3 months to open a bank account and to set up internet banking.

If you need a help, global expansion companies offer packaged incorporation services that include bank account opening support. Individual incorporation service providers generally do not commit to open a bank account for new foreign subsidiary companies.

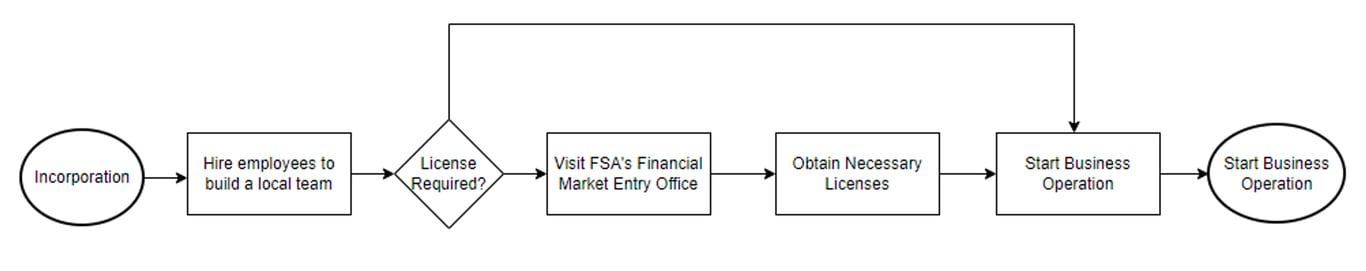

Obtain Proper License

After incorporation, some of companies may need to obtaion proper licenses to start business in Japan. General process is:

Understand what license is required by consulting with legal professionals and regulators’ support desks/offices.

Hire a local compliance officer, if it’s required for the proper license.

Apply license and complete registration with the compliance officer and/or law firms’ support.

Join proper self-regulatory organizations and make use of the designated dispute resolution organizations.

Fin-Tech Companies

Some of businesses that FinTech companies conduct may require licences by the regulators in Japan. Before getting advice from law firms, it’s highly recommended for you to contact the FinTech Support Desk of the Financial Services Agency, Japan (JFSA) with your intended business activities. They can respond to your initial questions on the regulations for FinTech businesses and what licenses may be required. Then licensing related service providers, who are mostly lawyers, can support with professional interpretations of laws and regulations for your license applications.

Asset Management Companies

For asset managers or business dealing with financial products, often the time a proper license is required by the regulators in Japan. The Japan Financial Services Agency (JFSA) provides a Guidebook for Registration of Investment Management Business and Other Financial Instruments Businesses.

Hiring an outstanding compliance officer will be crucial for obtaining the license smoothly. In addition, licensing related service providers, who are mostly laywers, can also provide services for licensing. Some of them may also provide free initial consultation on what license will be required, and/or compliance BPO service when you don’t want to hire a local compliance officer.

We also recommend the company to visit JFSA’s Financial Market Entry Office to understand the procedures of obtaining a proper license. JFSA provides the Financial Start-up Support Program (for the period of April 2024-March 2025). This program includes the subsidy to asset management companies that aim to register a financial license among Investment Management Business, Investment Advisory and Agency Business, Type I Financial Instruments Business, and Type II Financial Instruments Business. General process of subsidy program is found here.

Usually for Investment Advisory and Agency Business (IAA) license, it will take from 4 to 6 months in general, with the lawyer fee that is around JPY 10 to 12M.

External Resources

Disclaimer: All of the contents of this webpage are copyrighted by Visual Alpha Co., Ltd. (“Visual Alpha”) and may not be reprinted, duplicated, etc., without the prior written permission of Visual Alpha under relevant copyright laws. This webpage describes only our general and current observations, and Visual Alpha is not rendering professional advice or services by this webpage. No warranties of any kind are given with respect to the information disclosed herein, or with any use thereof. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.